There are lot of person’s who are maintain his day to day accounting in Tally.ERP 9 software. All we know there are different types of duties and taxes in which we have to calculate tax amount during making entry in sales, purchase, sales return and purchases return vouchers. But, do you know you can start calculation of tax using groups other than duties and taxes in Tally ERP 9. If you don’t know then let’s start to read this article how to do this job in Tally.ERP 9.

Must Read: How to remove or restore lines in reports of Tally ERP

Normally during working on the Tally.ERP 9 accounting cum inventory software we need to calculate different type of tax amount on the total value or sales or purchases vouchers. But sometime we need to charge tax amount on different indirect expenses during working on active company of Tally.ERP 9.

Calculation of Tax Using Groups other than Duties and Taxes in Tally ERP 9

Most of novice user’s don’t know how to take advantage of this feature in Tally.ERP 9. But if you want to calculate tax amount just like discount, commission, freight etc ledger accounts which are not ground in Duties and Taxes group. Then one question arise in the mind how to start calculation of tax using groups other than duties and taxes in Tally ERP 9. There is no need to worry after taking few simple steps your problem is resolved. You just take few given simple steps in active company of Tally.ERP 9 to solve your problem.

Step 1: Open an existing company or create a new company in Tally.ERP 9 software.

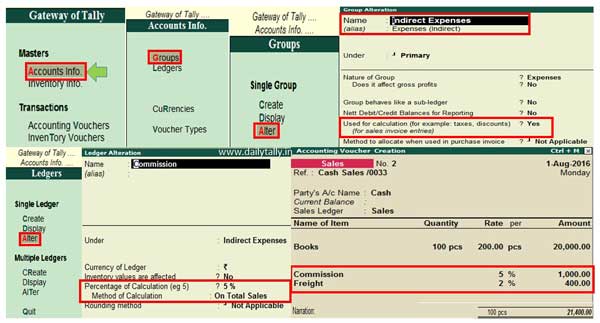

Step 2: Open Group alteration window from GOT (Gateway of Tally) > Select “Accounts Info.” option placed in the “Masters” group.

Step 3: Select “Groups” option in Accounts Info. window. Select “Alter” option in the Single Group category which is placed in Groups windows. Select the “Indirect Expenses” or “Expenses (Indirect)” group in the list of available groups.

Step 4: In Group alteration window set “Used for calculation (for example: taxes, discounts) ? – Yes” and save the information.

Step 5: Create or alter required ledger accounts from Accounts Info. > Ledgers > Create / Alter. Set the “Percentage of calculation (eg 5)” and “Method of Calculation” as per given in the image. After save the information either pressing enter key or press Ctrl+A quick save shortcut key of Tally ERP 9.

Step 6: Make an entry in the Sales voucher from GOT > Accounting Vouchers > Press F8 or click on the Sales vouchers including indirect exp. When you select commission or freight indirect expenses the amount is automatically calculated in the respective column and you’ll get final invoice amount.

Must Read: How to File Online Income Tax Return

I hope after reading this article you can understand how to start calculation of tax using groups other than duties and taxes in Tally ERP 9. If you have any query regarding this guide then please write us in the comment box. You can also share your knowledge with other because we believe practise makes a man perfect. Thanks to all.