Hello friends, This is a easy and simple guide for make entry of Branch Transfer Outward and Inward in Tally. You know very well about the Tally software. Branch Transfer outward and inward is used to easily transfer stock from one location to another using Tally software.

Tally is an accounting cum inventory software which provide different accounting cum inventory features to use different features as per your need.

It’s also provide different types of direct and indirect taxes like VAT, CST, TDS, TCS, SERVICE TAX, EXCISE and many more in statutory and taxation part. You know very well stock is an important part of our business, without proper maintain stock items you will not be able to maintain your accounts properly. Lot of time we need to transfer our stock items from one godown to another godown either in same state or any other state. After reading this article you will be able to use branch transfer outward and inward in Tally.

If you transfer any stock item within state in that case you have to make entry in “Stock Journal” (F7) voucher from one godown to another godown. But you face different problems when you want transfer your stock from one godown to another godown and both godowns are in different state. So, today I try to solve your problem how to make entry during “Branch Transfer Outward & Inward” in Tally or Tally.9 ERP software.

Must Read: How to use Bank Reconciliation Statement – BRS in Tally

How to make entry of Branch Transfer Outward and Inward in Tally:

If any organization having more than one branches, they can transfer his materials from one branch to another branch as per requirement. Inter branch transfer do not attract any tax, but proper accounting method is essential; and it’s to be reported in VAT return.

Step 1: Create a new company or open an existing company.

Step 2: Turn on Vat facility from Press F11 (Company Features) -> F3 (Statutory & Taxation)-> Vat Applicable – Yes, then save all information.

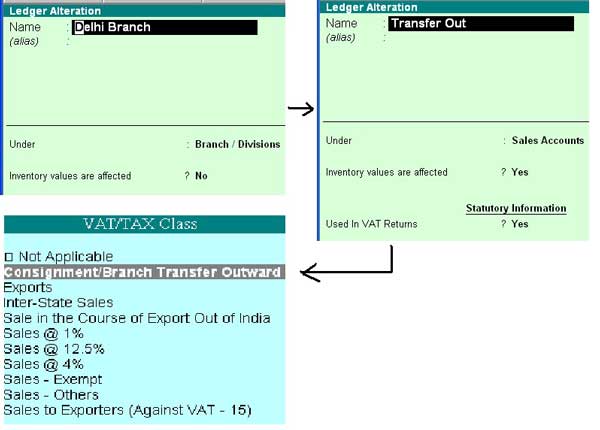

Step 3: Create ledger a/c from Accounts Info -> Ledgers -> Create.

Step 4: Now open the voucher and make Transfer entry in sales voucher as following.

Must Read: Interstate Stock Transfer with Stock Journal Voucher in Tally

Note: In case of branch transfer there is no tax components at the time of transfer of goods from one branch to another branch. You have to select “F” form during transfer outward entry in sales voucher to transfer stock from interstate branch transfer. Branch Transfer Inward, It is similar to branch transfer outward. Only the difference is ledger, in case of inward the ledger will be transfer in under Purchase and Branch Transfer Inward category.

I hope you like this Branch Transfer Outward and Inward in Tally guide. Give your important suggestions in the comment box regarding this post. Thanks.

Akila

Sir

we have a branch at bangalore and our main office at coimbatore. we transferred some stocks from bangalore to coimbatore.

what entry we have to made in tally.

Patrick Musyoka

Hello Sir, help record the following

Local purchases of 10 pcs of Honda bikes @4000 each from somitek Motors and input VAT of 12.5% was applicable . Vide bill no sm – 033. These goods were transferred to a branch outside the state (Raipur branch) . (Remember being manufacturing Co upto 4% of input tax is disallowed)

PASS VAT ADJUSTMENT ENTRY

Muzammil

I am working in a stationery trading company we are selling office stationery item we take some item for our office use how to enter in tally

Divya

i want to transfer stock from headoffice to godown.. please tell by what price it should be transfer. I mean last purchase price or avg cost or what.. please suggest

nani

charitable origanisation cheque deposited in one branch but four branch/division

you will pass entry but cheque is pass all the branches and you will write the narrition branches names ok

Amit Sharma Post author

At the month end you have to pass given entry in the Journal Voucher.

You have to pass Main HO account Dr. and Branch account Cr.

I hope your query will be solved.

piyush

sir,

i am facing a lot of problem in tally because of following issues,

i am in the business of renting laptops so i treat them as my assets while i purchasing. so how to record them in stock and keep a track as to who have how many laptops

thanks

HEENA YADAV

Respected Sir,

Our company have two branches Mumbai & U.P head office at Rewari (Haryana) goods sold from mumbai branch but payment received in Rewari branch I passed entry in Rewari branch in Receipt vouch

Mumbai branch a/c. Cr

Bank A/c. Dr.

But in Mumbai branch what entry will pass ?, pls guide me.

Atul tailor

DR Rewari Branch

CR Sundry Creditors

priti kedia

subdry creditors a/c ko credit q krege? (when we sold goods in that time we debited to ‘sundry debtors’ thewn we should be credited to sundry debtors , not sundry creditors)

enry will be passed;-

Rewari branch a/c dr

To sundry debtors a/c

Penujuri Kavitha

Respected sir,

I am accountant in one of the Multi sprciality hospital . There is maintaing Hospital and Pharmacy. In pharmacy , they are tr.the stock of medicines to Hospital OP/IP wards , ICU ,NICU etc for patient’s emergency purpose.

Entries as follows:

In the books of Pharmacy:

Hospital A/c – Dr [ Current Asset ]

Stock tr.to Hospital A/c – Cr [Including Vat] [ Under Sales Account]

In the books of Hosptial:

Stock tr.from Pharmacy A/c – Dr [ Under expenditure ]

Pharmacy A/c – Cr [ Under Liability ]

is it correct or not

Please confirm me

Rupesh

Dear thanks for this post. can we put puchase value for branch trf ?

Darathy

I am working in one of the charitable Organisation. We have four branch/Divisions. We have received one cheque for these four branches and the cheque is deposited in one branch account i.e.direct income account. In Tally how I will make transfer entry in the month end and also whether let us know we will put up a cheque for transfers or not.