Dear Friends, You know very well about the Tally software. Tally is an accounting cum inventory software which provide different accounting, inventory features and also provide statutory and taxation facility. Today, we discuss how to use Vat in purchases import and sales export in Tally.

When we purchases any goods from other country or sold any goods to other country and want to know what is the treatment when vat is applied on that condition. Let me clear one thing by this article that during purchases import and sales export facility vat is not applied on that condition. When you purchase any goods from outside of India means import of the goods or sold any goods outside of India means export of the goods, then you have to take few important steps in Tally accounting software.

Must Read: How to use Track Additional Cost of Purchases in Tally

How to Use Vat in Purchases Import and Sales Export in Tally

Step 1: Create a new company or open an existing company.

Step 2: Turn on Vat facility from Press F11 (Company Features) -> F3 (Statutory & Taxation)-> Vat Applicable – Yes, then save all information.

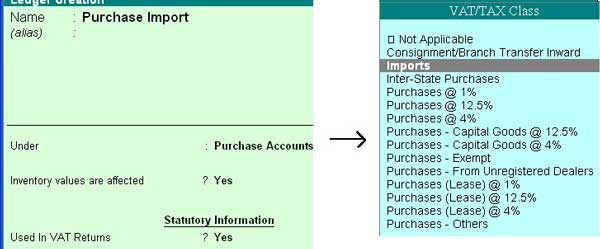

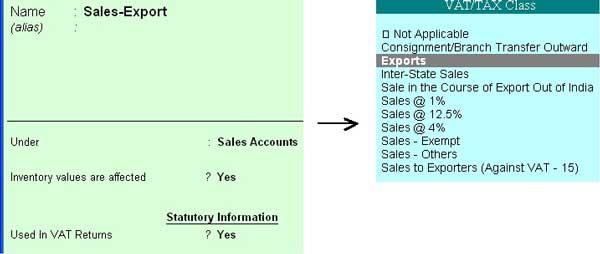

Step 3: Create ledger a/c from Accounts Info -> Ledgers -> Create.

Ledger creation for import goods

Ledger creation for Export the goods

Step 4: In case of Import goods make entry in Purchase (F9) voucher or In case of export goods then make entry in the sales (F8) voucher.

Note: VAT (Value Added Tax) & CST (Central Sales Tax) both are exempted in case of Export & Import.

Purchase Voucher – Make entry in the purchases voucher for import any stock item as given below.

Sales Voucher – Make export entry in the sales voucher same as above entry, but select Sales – Export ledger a/c.

Must Read: How to use Purchases Voucher in Tally

I hope you like this post. Give your important suggestions in comment box. Thanks.