Service Tax and service tax forms very important for business. In Tally or any other accounting software you can easily get service tax forms if service tax entry made by you in active company.Dear Friends, You know very well about the Tally software and What is Service Tax and Service Tax Forms . At present time Tally is one only most popular accounting cum inventory software that handles the day to day all routine operations of any business unit very effectively.

Must Read: Pay online self assessment tax and advance tax

It is widely accepted by the different accounts for its user friendly nature. Tally provides different accounting and inventory features that allow any user to maintain his company accounts effectively. After reading this article you will be able what is the service tax and service tax forms we have to use during the current financial year.

Service Tax and Service Tax Forms

Definition of Service Tax:

Service tax is an indirect system of taxation which is imposed on specific category of service called “Taxable service”. The list of taxable service is declared by the central government. If any service is not fall under taxable service then we could not charge service tax on the category. The Central Board of Excise and Customs (CBEC) collect the service tax which is charged only on taxable serivces. Service tax is applicable whole of India but except of Jammu and Kashmir.

Service Tax is a form of indirect tax imposed on specified services called “taxable services”. Service tax cannot be levied on any service which is not included in the list of taxable services. Over the past few years, service tax been expanded to cover new services.

The objective behind levying service tax is to reduce the degree of intensity of taxation on manufacturing and trade without forcing the government to compromise on the revenue needs. The intention of the government is to gradually increase the list of taxable services until most services fall within the scope of service tax. For the purpose of levying service tax, the value of any taxable service should be the gross amount charged by the service provider for the service rendered by him.

Excise and Service Tax will be progressively altered and brought to a common rate. In budget presented for 2008-2009 It was announced that all Small service providers whose turnover does not exceed INR 1,000,000 need not pay service tax.

Service Tax was first brought into force with effect from 1 July 1994. All service providers in India, except those in the state of Jammu and Kashmir, are required to pay a Service Tax in India. Initially only three services were brought under the net of service tax and the tax rate was 5%. Gradually more services came under the ambit of Service Tax. The rate of tax was increased from 5% to 8% w.e.f 14 May 2003. From 10 September 2004 the rate of Service Tax was enhanced to 10% from 8%. Besides this 2% education cess on the amount of Service Tax was also introduced. In the Union Budget of India for the year 2006-2007, service tax was increased from 10% to 12%. On February 24, 2009 in order to give relief to the industry reeling under the impact of economic recession, The rate of Service Tax was reduced from 12 per cent to 10 per cent.

Important Points of Service Tax:

All services are not taxable.

Service tax charge only on taxable services.

Service tax in an indirect tax.

Service tax payable only on receipt basis.

Service provided by a person is termed as his output service. Similarly any service avaled by the person is his input service.

Current rate of service tax is 12.36% (12% charge on bill value, 2% on tax and 1% on previous value)

Must Read: How to make entries of Service Tax in Tally

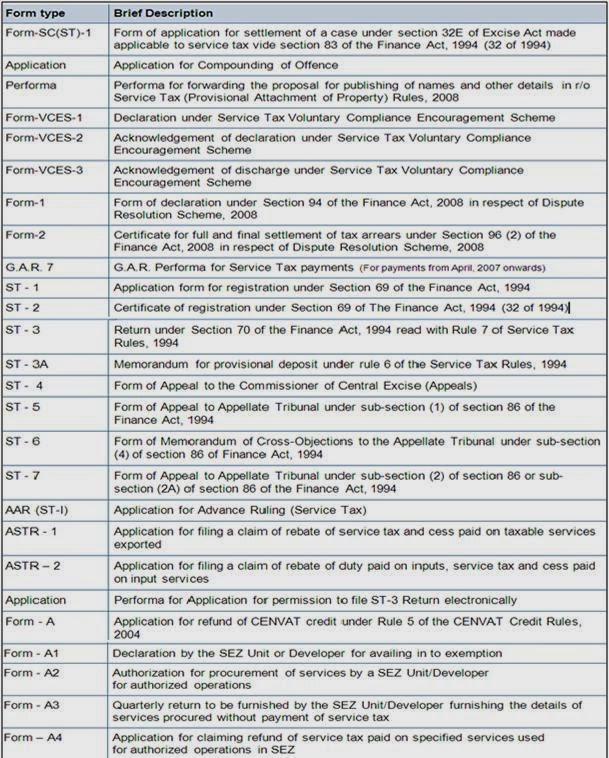

Service Tax Forms

Must Read: What is the due date of Direct and Indirect Tax Payment

I hope you like this Service Tax and Service Tax Forms guide from which you will be able to understand Service Tax and Service Tax Forms without any extra efforts. If feel any problem in this guide then please use comment box. Thanks to all.