During interview for the post of accountant most of person face a question what is the meaning and format of final statements? In this article will share you exact answer of this question. Financial statements are formal records of the financial activities and position of a business, person, or other entity. Relevant financial information is presented in a structured manner and in a form which is easy to understand.

All related person of business and accounts known importance of final statements. In this article today we will discuss what is the meaning and format of final statements. These statements are prepared by each registered dealer at the end of each financial year. These final statements used to show “Gross Profit / Gross Loss”, “Net Profit / Net Loss”, “Cost of Goods Sold”, “Financial Position” of your businesses.

Must Read: Introduction and History of Tally

After reading this article you able to know what is the a final accounts and how to preparing this final accounts in specified formats. To prepare final accounts you will need to work out the trading account, profit and loss account, and balance sheet.

You will need all financial information and statements, including sales, purchases, staff costs, bank fees and any other charges related to the business. You will also need to know how much money is owed to the business.

Meaning and Format of Final Statements:

The financial statements of an organization made up at the end of an accounting period, usually the fiscal year. For a manufacturer, the final accounts consist of (1) Manufacturing account, (2) Trading account, (3) Profit and Loss account, and (4) Profit and Loss Appropriation account.

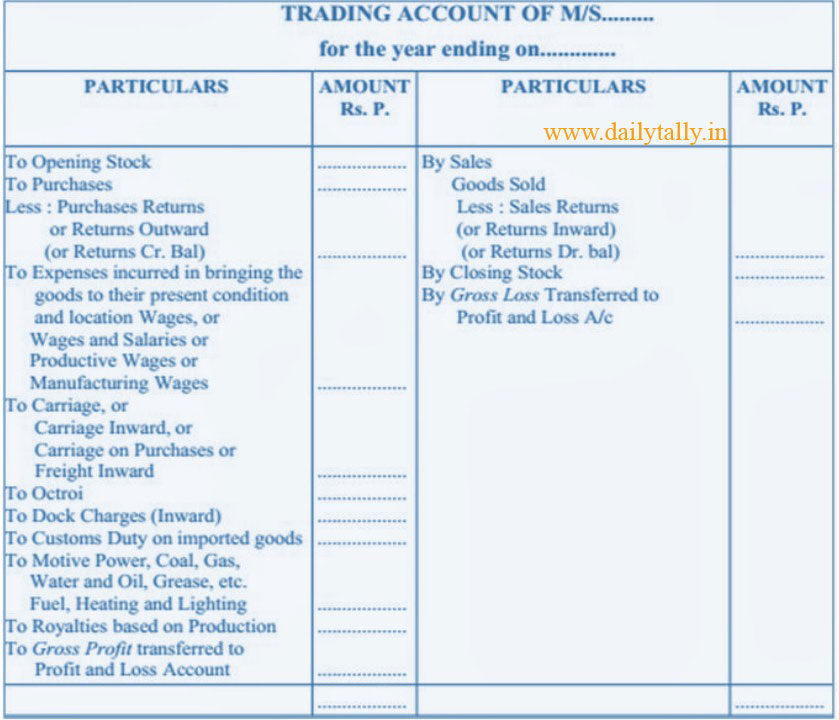

A commercial company’s final accounts will include all of the above except the manufacturing account. Together, these accounts show the gross profit, net income, and distribution of net income figures of the company.Trading Account:The trading account is used to show “Gross Profit or Gross Loss” of you business at the end of each financial year.

Must Read: Interstate Stock Transfer with Stock Journal Voucher in Tally

Gross Profit:

Gross profit is the difference between sales revenue and the direct cost of the goods sold.

Cost of Goods Sold:

It is the cost of purchasing the goods from suppliers (in case of retailing business) or the cost of producing the goods that are sold.

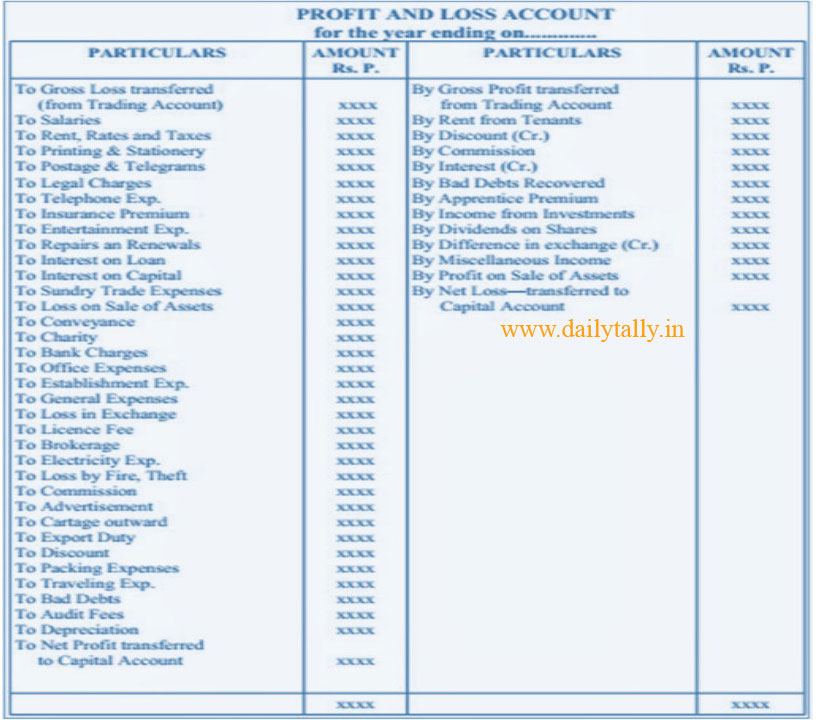

Profit and Loss Account:

This account shows the net profit of the business. This statement is used to show the “Net Profit or Net Loss” of your business at the end of financial year.

Net profit = (Gross Profit – Expenses and Overheads) + Income from non trading activities

Appropriation account is that part of the profit and loss account which shows how the profit after tax is distributed. This profit can be distributed as dividends or can be kept in the company as retained profits.

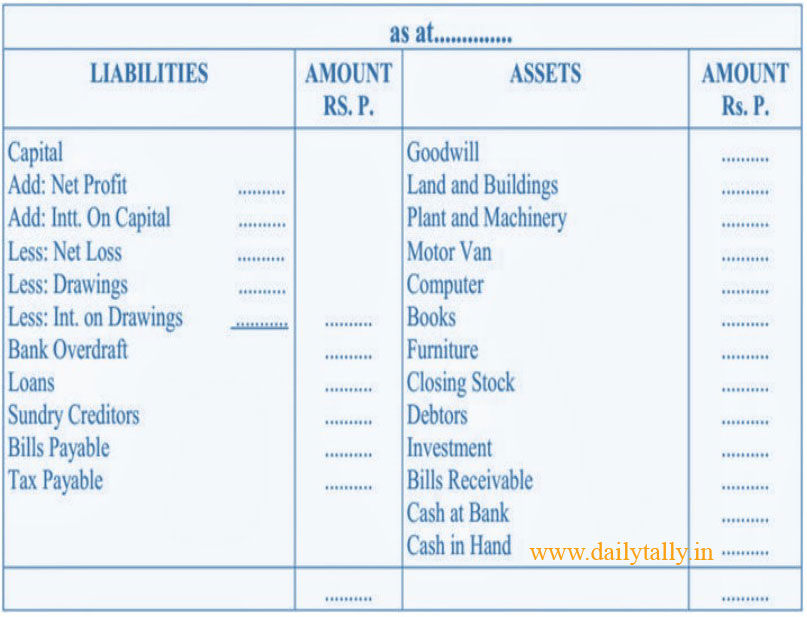

Balance Sheet:

Balance sheet is used to show the value of a business’s assets and liabilities on a particular date. Balance sheet is used to record what the firm owns (assets), what it owes (liabilities), what it is owed and how it is financed (owner’s equity). You can use following formats to prepare final accounts in your accounting….

Trading Account Format

Profit and Loss Account Format

Balance Sheet Format

Must Read: Distinction in Capital Expenditures and Revenue Expenditure

I hope you like this Meaning and Format of Final Statements post. Give your important suggestions in comment box. Thanks.

MANJU G

informations are excellent. please send to mail to me

ashalata pagad

nice

Tulsi Prasad

Good

shireesha

It s very good.easy to under stand to each and every one.bt i have one doubt dep on assets(machinery land &buildigs.etc )are not mentioned.

Akshita singh

Early understanding of that format